Condo Insurance / Part 2 — Other Parties

- cbeckman98

- Jun 8, 2021

- 3 min read

The Condo Association

The condo association policy will generally cover the shell of the building including roofs, balconies, decks, and patios. The common areas are covered under the association policy. The level of interior finish covered by the association is based on the bylaws or deeds. You need to know what these terms are when you set your dwelling limit of insurance. The limit of insurance that is needed by the association can vary widely based on the coverage for interior finishes. Is this limit carried by the association adequate? Does the association policy have a coinsurance clause that could apply if they are not insured to value?

The deductible carried by the association may be an assessment item back to unit owners. A large deductible on the part of the association may create a liability for unit owners. You should be aware of how the association selected their limits of insurance and how they chose the deductibles. The association insurance policy has impacts on the limits of insurance needed by the unit owner.

The risk management practices of the association will ultimately impact the unit owners. This goes beyond insurance programs to facility maintenance, insurance program management, and control over operations and activities in common areas. Poor risk management techniques will cause premiums to rise, coverages to be restricted and deductible to increase. This causes increased association fees and potential higher loss assessments.

Unit owners must remember that decisions at the association level have immediate implications for their insurance program.

Your Neighbor

The activities of your neighbor can create loss exposures in your units. Overflowing plumbing fixtures, fire exposures, improper maintenance of equipment in the other unit can cause an event that impacts your unit. The lack of maintenance on another unit owners’ part can cause a significant loss to all occupants within that building shell.

Does the other party have insurance in place?

Many associations bylaws and deeds require owners to carry insurance. How is this enforced and monitored? Many association bylaws have subrogation waivers to prevent owners and the association insurers from trading claims back and forth. Does this also apply to your neighbor’s policy? In a shared environment such as a condominium building the actions and inactions of your neighbor can be impactful.

What you need to know...

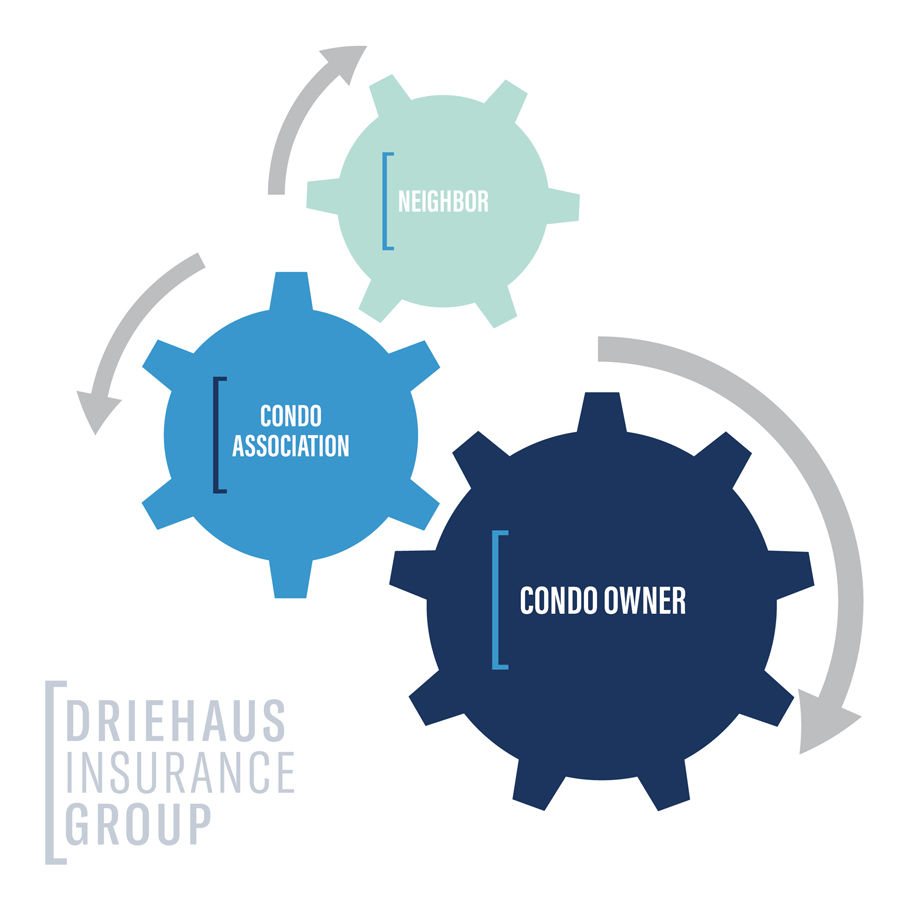

Condominium insurance is not a stand-alone environment. There are interactions between your program, the association and even your neighbors’ program. You need to be aware of not only how you manage your program but what changes in the association program and actions can have on you.

We recommend that you place your personal program with the same agency as the association and if possible, with the same carrier. This means any behind the scenes claims issues are handled at the insurance company level, not with you caught in the middle.

Having an agent who knows the association risk can mean you get feedback on changes and coverage needs for your policy.

The Driehaus Difference

A condominium owner insurance program is not a set it and forget it process. You need to understand the unique coverages, unique exposures, and the impact that different company forms will have on your program. The insurance experts at Driehaus Insurance can guide you through the process to make the best choices for the protection you need. Call us at 513-977-6860 or contact us on the internet at www.driehausins.com

Comments